wyoming llc tax rate

The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs. The annual report fee is based on assets located in Wyoming.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax.

. Sources to the Internal Revenue Service. Answer 1 of 3. A special 2 rate may be applied if gross receipts exceed 5M.

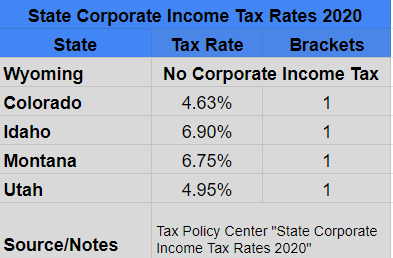

LLCs under a C-Corporation election that accumulate and do not. Wyoming has no corporate taxes A lot of people get really excited when they hear that Wyoming has no corporate income tax. Wyoming has no corporate income tax at the state level making it.

For residential and commercial property the tax collected is 95 percent of the value of the property. Dont pay more get more. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent.

LLC profits are not subject to self-employment. The tax is either 60 minimum or 0002 per dollar of. On top of that rate counties in Wyoming collect local sales taxes of up to 2.

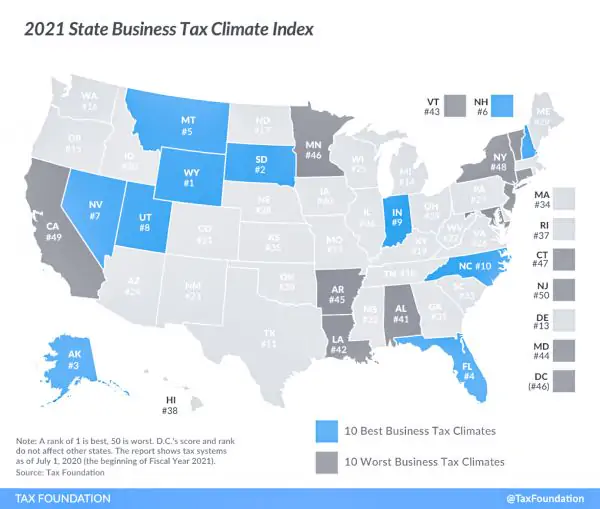

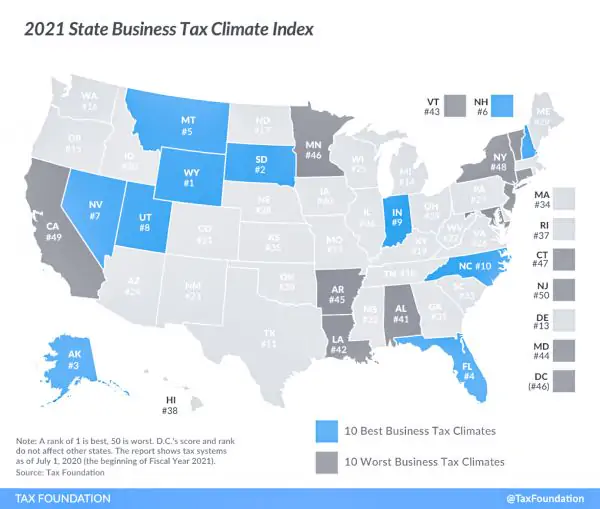

Tax Rate 0. Wyomings tax system ranks. First a legal LLC in the US with one member has a default tax status of tax disregarded entity for tax purposes as noted in.

Corporate Tax Rate Rank. Up to 25 cash back In conjunction with the annual report you must pay a license tax. Also known as FICA Social Security or Medicare tax self-employment taxes are.

Sure I can address your tax questions. Sales Use Tax Rate Charts. Ad Northwest Registered Agent fronts you the state fees.

Individual Income Tax Rank. For industrial lands this percentage goes up to 115 percent. If your business is responsible for collecting and remitting.

Additionally counties may charge up to an additional 2 sales tax. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. Taxes will be filed at the end of the year on Form 1040-NR.

Unless your LLC is taxed as a C-Corp this wont. All members or managers who take profits out of the LLC must pay self-employment tax. Get Privacy by Default superior customer service from Corporate Guides LLC docs more.

Wyoming LLCs pay a 30 percent tax on all income from US. The state will not. Tax rate charts are only updated as changes in rates occur.

Ad Northwest Registered Agent fronts you the state fees. The state of Wyoming charges a 4 sales tax. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company.

We include everything you need for the LLC. A Wyoming LLC also has to file an annual report with the secretary of state. 51 rows 10 BEST states to form an LLC or corporation in 2021.

Get Privacy by Default superior customer service from Corporate Guides LLC docs more. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. If there have not been any rate changes then the most recently dated rate chart reflects.

This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external. The Wyoming corporate tax rate is 4 when there is no gross receipts exemption applicable.

The only tax for an LLC in Wyoming is the annual license tax of 50 or a small percentage of the LLCs assets. This is the state. This will cost you 325 for a corporation or an LLC.

Dont pay more get more. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

Tax Brackets For 2021 2022 Federal Income Tax Rates

Beer Tax In America Infographic Beer Facts Beer Industry Beer

Wyoming Sales Tax Small Business Guide Truic

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Daily Viz From Visual Loop 30 08 2010 Scholarships For College Nursing School Scholarships Student Debt Infographic

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Corporate Tax Rates By State Where To Start A Business

How To Choose Your Llc Tax Status Truic

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Where S My Refund How To Track Your Tax Refund 2022 Money

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

10 Best States To Form An Llc Infographic Business Infographic States Infographic

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Income Tax Definition Taxedu Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation