maryland digital advertising tax effective date

732 took belated effect on New Years Day 2022. Effective July 1 2018 remote sellers selling tangible personal property or digital property delivered or transferred electronically to a purchaser in Kentucky to collect sales tax if the remote seller had 200 or more separate transactions in the state or their gross receipts exceeded 100000 in the previous or current calendar years.

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

The sales and use tax rate for electronic smoking devices is 12 of the taxable price.

. The complaint alleged that since at least January 2012 Diversified engaged in an ongoing pattern or practice of race discrimination against African-American job applicants in Maryland Washington DC and Philadelphia metropolitan areas by refusing to hire Black applicants for custodian lead custodian or porter positions and racially. 412020 Alaska Remote Seller Sales Tax Commission. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The legislation became effective March 14. PayPal is one of the most widely used money transfer method in the world. There are two different types of release forms.

Marylands first-in-the-nation digital advertising tax enacted initially as part of HB. This type of form includes the information of both involved parties details of the photos taken signatures and the date. The Maryland Real Estate Commission is attempting to better enforce ALL advertising compliance with the law this includes digital as well so that no advertising is misleading to the public.

Effective date unique for each municipality get the details. ALL advertising the Commission finalized the regulation Relations to the Public specifically as it pertains to digital advertising and detailed. It is used for models who have reached adult age and who are considered legally competent.

In 2014 by state Tax revenue from the taxi market in Russia 2015-2019 Share of wealthy individuals paying the wealth tax in Spain 2011-2019. The region under British control was commonly called India in contemporaneous usage and included areas directly administered by the United Kingdom. The actual tax amount that will be applied to your order and charged to your payment method may differ from the estimate provided.

Consumer Complaint Investigation PropertyCasualty 200 St. Adjunct membership is for researchers employed by other institutions who collaborate with IDM Members to the extent that some of their own staff andor postgraduate students may work within the IDM. Paul Place Suite 2700 Baltimore MD 21202.

A transferor of property with or without consideration may directly transfer the property to a transferee to be held in beneficiary form as owner of the property. The sales and use tax rate for vaping liquid sold in a container that contains 5 millimeters or less of vap-ing liquid is 60 of the taxable price. The British Raj r ɑː dʒ.

In box 41a Enter the amount of sales of digital products that are subject to tax at the 6 rate. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. We also accept payment through.

New Brunswick is a city in and the county seat of Middlesex County New Jersey. Compare an individual-level perspective on digital media use with a systems-level perspective. When you place your order we may estimate the tax and include that estimate in the total for your convenience.

NRS 111765 Property held in beneficiary form. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. Effective July 1 2019 a remote marketplace facilitator with more than 100000 in Pennsylvania sales in the previous 12 months is required to collect and remit sales tax on all sales into the commonwealth ie cannot opt out by complying with non-collecting seller use tax reporting requirements.

Seventeen states will hold a sales tax holiday in 2022 down from a peak of 19 in 2010 and unchanged from last year. Get 247 customer support help when you place a homework help service order with us. Effective date unique for each municipality get the details.

Passed by overriding the veto of Governor Larry Hogan R the law was initially to take effect on March 14 2021. It is acceptable in most countries and thus making it the most effective payment method. 17d of the Maryland Constitution as Chapter 37 of the Acts of 2021.

Watch the latest news videos and the top news video clips online at ABC News. Effective date of transfer. The Commissioner may be contacted to file a complaint at.

For 3-year terms which are renewable. Federal government websites often end in gov or mil. Kingdom realm state or empire was the rule of the British Crown on the Indian subcontinent.

The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The statutory references contained in this publication are not effective until March 14 2021. 10272011 repealed effective 630.

The city is the home of Rutgers UniversityThe city is both a regional commercial hub for central New Jersey and a prominent and growing commuter town for residents commuting to New York City within the New York metropolitan area. Effective corporate income tax rates in the US. 412020 Alaska Remote Seller Sales Tax Commission.

For information on what qualifies as a digital product see Business Tax Tip 29 Sales of Digital Products and Digital Code on wwwmarylandtaxesgov. We may revise the pricing for products and services we offer. Breaking Local News NEXT Weather Community Journalism.

Sales tax holidays do not promote economic growth or significantly increase consumer purchases. Before sharing sensitive information make sure youre on a federal government site. The first is the general photo release form.

Digital products became subject to the sales and use tax on March 14 2021. Improving Lives Through Smart Tax Policy. New Brunswick is on the Northeast Corridor rail line 27 miles 43.

The gov means its official. It is also called Crown rule in India or direct rule in India and lasted from 1858 to 1947. The evidence including a 2017 study by Federal Reserve researchers shows that.

Build competence in discussing problematic media design with families. Maryland Insurance Administration ATTN. We accept payment from your credit or debit cards.

Learn challenges to foster children and their families due to the pandemic.

Will Digital Advertising Taxes Spread In 2021

Effective July 1 Saas Is Not Taxable In Maryland Again Forvis

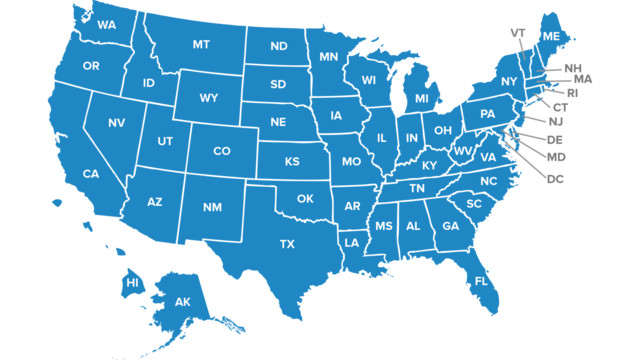

State By State Registration Requirements For Marketplace Sellers

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Taxnewsflash Digital Economy Kpmg United States

Digital Goods Now Taxable In Maryland Taxjar

Md Digital Advertising Tax Bill

Maryland Delays Digital Advertising Services Tax Bdo

Maryland Guidance On Digital Products Streaming Tax Kpmg United States

New Maryland Sales Taxes On Digital Products Computer Software E Books E Music Some Webinars And More Are You Up To Date Maryland Association Of Cpas Macpa

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Effective Management For Security Professionals Ie Business

State By State Registration Requirements For Marketplace Sellers

Corporate Secretary Certificate Template 2 Templates Example Templates Example Certificate Templates Free Certificate Templates Templates

Maryland Digital Advertising Tax Regulations Tax Foundation Comments